Braves Revenues Continue To Increase Despite Attendance Dropping in Quarter Three

Atlanta Braves Holdings reported another revenue increase for Q3, with mixed-use development offsetting an attendance drop

(For those that don’t know, my day job is working in finance. While I’m currently working with SBA borrowers in my current role, after graduating from Auburn University with my MBA, I spent years in commercial lending and corporate finance. It’s rare that I get to combine both my professional career and my passion for baseball for a newsletter, but this one was obvious.)

2025 was a tough season for the Atlanta Braves, with President of Baseball Operations Alex Anthopoulos remarking on Tuesday that it was “not fun” to miss the playoffs and that the Braves’ standard was to “be in the playoffs, year in and year out.”

But despite the losing record, quarter three revenues for Atlanta Braves Holdings were up from last year, increasing 7% from the same period in 2024.

Let’s talk about it.

Is it an equal comparison?

Unlike a lot of corporate earnings releases, there’s one giant factor that must be clarified up front when looking at the quarterly comparisons for the Atlanta Braves: How many home games did they play in each quarter?

Because, unlike a lot of businesses, BATRA 0.00%↑ revenues are highly dependent on home games - that’s where they make most of the baseball revenue in any given quarter, off of ticket sales, concessions, etc. When looking at quarter 3 of 2024 to quarter 3 of 2025, the Braves played 41 home games in each of the two quarters. Equal opportunity to make money.

But wait, what about the All-Star Game? Atlanta hosted the 2025 Midsummer Classic and wouldn’t that influence the numbers?

Yes, but indirectly. The All-Star Game and its related events don’t count as a Braves home game in this calculation, as it is put on by Major League Baseball. While Atlanta Braves Holdings does receive downstream benefits from increased traffic in The Battery Atlanta, it’s commonly understood that MLB receives the revenue from the actual game itself, not the team.

There are positive impacts to the All-Star Game being held in Atlanta, however, and you can see that in the financials.

Revenues were up on the baseball side

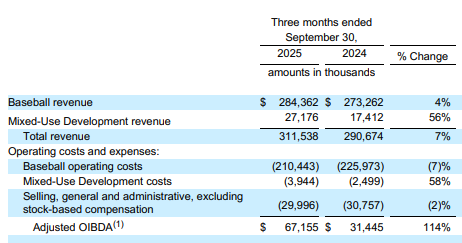

In Quarter 3 of 2024, the Braves hosted 41 home games and generated a total of $273M in revenue. This year, the same number of games resulted in $284M in revenue.

Not everything went up, however. Retail spending was actually down 6%, from $16.5M to $15.6M. That’s mainly a result of lower attendance.

Everything else, however, increased - baseball event revenue (the games themselves) went up 2%, thanks to contractual rate increases on season tickets, existing sponsorships, and new premium seating/sponsorships that weren’t in place last season. Broadcasting revenue was up 12%, thanks to additional streaming rights being granted this season to Gray Media.

While we don’t yet have exact attendance figures, it’s interesting to see that the lowered revenue didn’t hurt ABH in the end because they’re making more per customer that walks through the gates. With season ticket prices increasing yet again (a move that was not well received among A-List members), it’s likely that if attendance doesn’t rebound immediately, the team can still show a better profit to start next season.

The lowered attendance clearly matters, though, and got the attention of ABH executives. As team president Derek Schiller said on Wednesday morning’s investor call, “There is a relationship between team performance and ticketing and attendance.”

They also discussed spending on player salaries in response to the Los Angeles Dodgers running a massive payroll, with chairman Terry McGuirk saying, “We’ve always tried to be a leader in player compensation from the team standpoint.” McGuirk said that his goal was to be a top-five payroll team, and while they’ve stayed inside the top ten for multiple seasons, aiming for the top five “is a place I want to get to (and) I think we’re capable of doing that.”

Here’s where the All-Star Game helped things

Mixed-Use Development revenue for ABH was up 56% to $27M, although it’s still just a fraction of the $284M that the baseball side brought in. It’s important to note, though, that the Braves keep every penny of this revenue, as it is not subject to MLB revenue-sharing rules like baseball revenue is.

There are two main reasons for the increase: Pennant Park and the All-Star Game.

ABH acquired the Pennant Park office complex early this season, hilariously announcing the acquisition after game six of a seven-game season-opening losing streak. That acquisition, which did contribute some operating costs to the financials, is now fully online and contributing to the mixed-use development revenue stream.

The other reason is the All-Star Game, but more indirectly. Per reports, ABH does not receive a percentage of the revenue that the retailers in The Battery Atlanta generate, although I’ve not been able to confirm that one way or the other.1 For the record, ABH does state in their SEC filings that the Mixed-Use Development revenue is “primarily” rental income, but does not break it out or list any sort of royalties they may receive.

However, retail space in The Battery Atlanta is always at a premium, with a new tenant always on tap and ready to move in once someone else terminates their lease. And with the 2025 All-Star Game on tap, people I’ve spoken to told me that the interest list for retail space was longer than it’s ever been, naturally resulting in higher rents per square foot for new tenants that came online in the last year or so.

Again, we can’t directly quantify a lot of this, but it makes sense based on how these things typically work in my experience.

Mixed-use development income really helped with OIBDA

Just looking at revenue isn’t always the best way to evaluate a business's health, as costs are also a factor, and gross revenue is often adjusted through various accounting measures to account for different factors.

So let’s talk about OIBDA.

You may be familiar with or have at least heard the term ‘EBITDA’ - Earnings Before Interest (that you paid), Taxes, Depreciation, and Amortization. It’s a standard accepted measure of a company’s profitability from its core business operations.

The Braves don’t use that. They use a non-GAAP measure2 called OIBDA, Operating Income Before Depreciation and Amortization. It’s not better or worse than EBITDA, just different.

In essence, an incredibly simplified way to think about OIBDA is “how much cash flow does the business have to pay its bills?”

And when looking at OIBDA, you can really see the impact of the Mixed-Use Development.

Here’s a screenshot of the financial chart comparing the two quarters:

OIBDA more than doubled, increasing 114% in the quarter. The reason was twofold: Mixed-Use Development Revenue increased by $10M, almost the same amount as Baseball Revenue, and baseball operating costs, which include payroll, etc, dropped $15M.

The Battery Atlanta, combined with Pennant Park, is directly helping pay the bills for the Atlanta Braves.

So, what does this all mean?

There are several key conclusions that can be drawn from these financial results. And believe it or not, it’s not that “attendance doesn’t matter.”

Yes, the team’s revenue went up quarter over quarter despite attendance being lower. But the organization clearly doesn’t want to rely on that trend continuing, discussing being aggressive this offseason at adding players while they’re in a “win-now” window. They understand that while they can use more premium areas, sponsorships, etc, to offset attendance drops, they do better when they spend money. And they’re committed to spending that money, knowing that they’ll make it back through the business operations of the team.

Now, let’s see how that commitment to grow payroll manifests itself this offseason.

In my career, I’ve seen it work both ways.

“GAAP” means Generally Accepted Accounting Principles, which are in essence the standardized rules for accountants on how to disclose financial information. You’re not required to use them if a different measure makes more sense for your company, but GAAP is the default for most companies and makes comparisons easier.

Very interesting number crunching.

Do you really believe McGuirk honestly would have the Braves in the top five of annual payrolls?

Haven't the Braves hired a new assistant General Manager ?

Pete Putila comes from the Giants. What does in mean ? Who did he replace ?

Hopefully it shakes up the farm system.